🎉 Waltz reaches $50M💰 in funding to support LATAM growth 🎉 Read the full story here

Did you know that Florida is the largest producer of oranges in the United States? Most Americans enjoy their morning cup of orange juice, thanks to Florida!

Florida’s real estate market is just as vibrant. It offers everything from charming single-family homes to beachside condos and sleek urban apartments. It’s no surprise that Florida consistently ranks high on the list for foreign investors. But buying property in Florida as a non-U.S. citizen comes with unique challenges. The process can be complex and time-consuming if you try to navigate it on your own. Keep reading to learn more about our mortgage options and what you can expect out of the Florida real estate market.

We are providing the following discussion to you for informational purposes only. All investments, including real estate, involve risk, and we encourage you to invest carefully. The information in this article is not intended to replace or serve as a substitute for any legal, real estate, tax, or other professional advice or service. You should consult with a professional in the respective legal, tax, accounting, real estate, or other professional area before making any decisions or entering into any contracts relating to a rental property.

A DSCR loan is an investment property loan used to finance rental real estate. Unlike traditional mortgages, it doesn’t look at your job history, personal income, or tax returns. Instead, the lender focuses on the rental income the property is expected to generate.

If the rent covers the monthly loan payments and provides some buffer, you may qualify. That makes DSCR loans especially useful for investors who want to build or expand a real estate portfolio without relying on personal income documentation.

DSCR loans are designed for investors who want to grow a real estate portfolio without relying on traditional income verification or U.S. credit history. Whether you're buying your first rental property or scaling across markets like Florida, DSCR loans offer flexibility that conventional loans don’t.

Here are some key benefits:

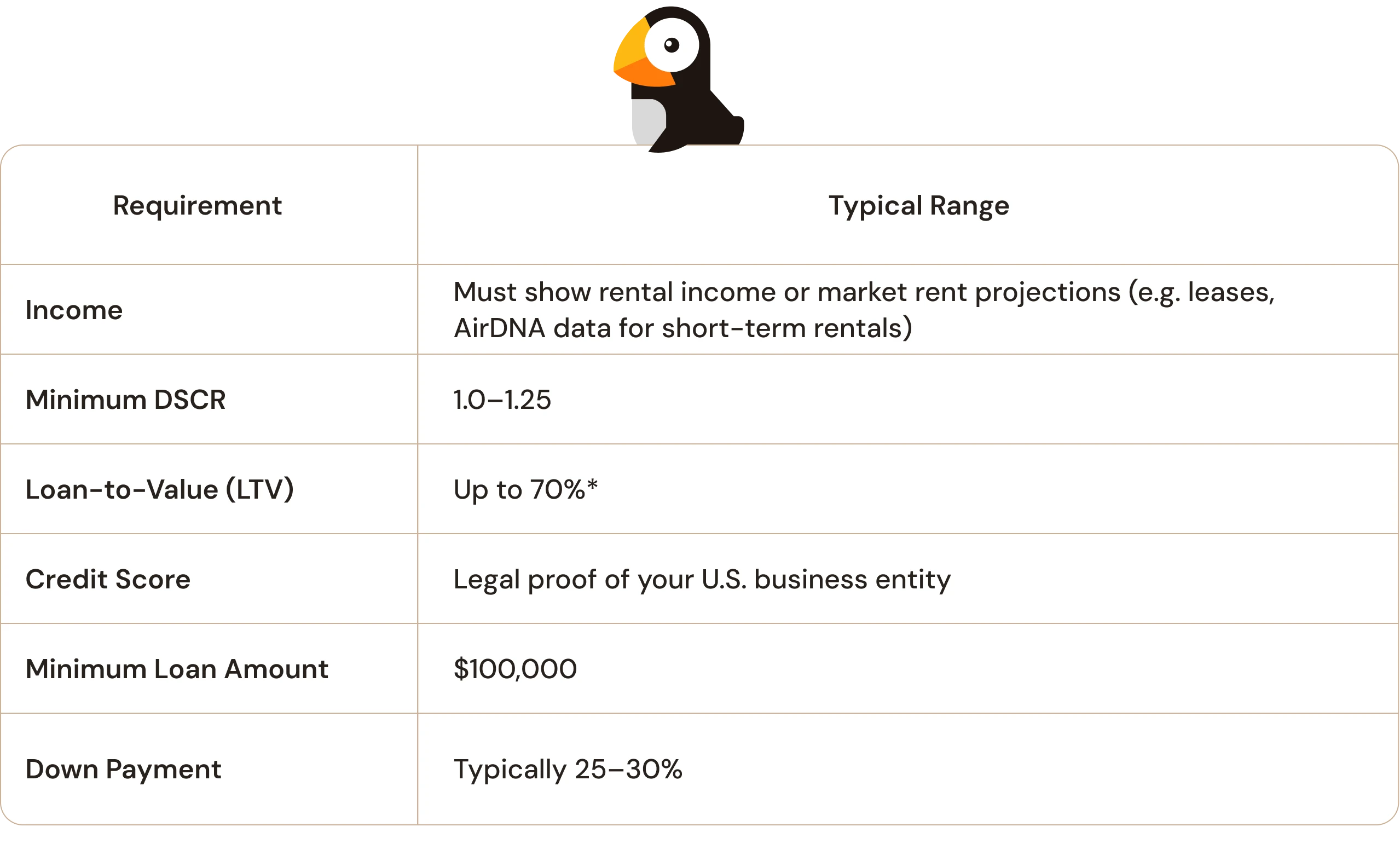

Every lender has its own set of guidelines and criteria, but there are certain requirements that most lenders adhere to. These include:

Most Lenders: U.S. lenders prefer to verify income from domestic sources, because it’s easier to do so. This usually means that underwriters inspect U.S.-earned income less harshly than foreign income. However, if your income originates outside the U.S., some lenders may be more cautious and could delay or deny your approval.

Waltz: At Waltz, we understand that income documentation can vary greatly depending on your country of origin. While we do consider your personal income, the primary factor in our evaluation is the rental income potential of the property you're purchasing. Our ultimate goal is to simplify the process, so you can get approved faster.

Most Lenders: Many lenders may require a down payment of 30% and even up to 50% of the loan amount. In some cases, this could be even higher. Additionally, they may ask you to keep a certain percentage of the loan amount as a reserve in your bank account. This reserve is meant to cover scenarios where the property is vacant or needs maintenance and repairs. These requirements can often be a barrier for some buyers, making financing options more difficult to access.

Waltz: The down payment requirements for our loans vary based on the individual buyer's situation. While 30% is the usual standard, some buyers may qualify for a down payment as low as 25%. Our goal is to tailor the loan terms to fit your unique needs, making the process easier and more flexible.

Most Lenders: Typically, lenders will ask for your passport and visa. For loans on investment properties, they often require the loan to be made to a U.S.-based LLC, with you as the personal guarantor. In such cases, they may also ask for the LLC's operating agreement.

Waltz: Establishing proof of identity (KYC) is a standard practice for investment loans. To verify your identity, all we require is a valid passport, which can be from your home country. If you don’t yet have an LLC, we can assist you in setting one up. With our Investor Toolkit, you'll receive an LLC along with an Employer Identification Number (EIN)—and it’s ready in just minutes!

Most lenders: Credit scores play an important role in loan approval. While some lenders may accept scores as low as 640, the real challenge for international borrowers is the reliance on U.S. credit history. For foreign borrowers who don’t have a U.S. credit score, this can make it much harder to get approved. Even if you have a strong credit score in your home country, the absence of a U.S. credit history can be a significant obstacle.

Waltz: As a non-U.S. citizen, you may not have a U.S. credit score. That’s why we don’t require one for foreign national applicants. Instead, we assess your creditworthiness by reviewing your credit history from your home country, helping to ensure a fair evaluation of your financial standing.

Need a quote? Fill out this form to get started.

Florida investors using DSCR loans should be prepared to meet a consistent set of eligibility standards, regardless of whether they’re investing in long-term or short-term rentals. While these requirements can vary slightly by lender, most follow a similar structure.

Here’s a quick look at the most common DSCR loan criteria in Florida:

Meeting these requirements doesn’t guarantee approval, but they’re a helpful benchmark as you prepare documents and evaluate investment properties. Waltz makes the process easier by verifying your rental income, helping you form an LLC if needed, and offering competitive DSCR loan terms across Florida.

Florida is one of the most active and resilient real estate markets in the U.S. The combination of tax advantages, strong population growth, and tourism demand continues to attract domestic and international investors. Still, every market has trade-offs—and Florida’s climate and regulatory environment are no exception.

Florida is rich with investment opportunities, thanks to its favorable climate and growing population. Five cities are particularly attractive for foreign national investing:

Home to both Walt Disney World and Universal Studios, the "Theme Park Capital of the World" continues to boom. Orlando has a high demand for rental properties thanks to the city’s tourism and thriving job market, which is expected to grow by an additional 7.2% through 2029. This makes Orlando one of the top three metro areas for employment growth. Orlando also faces a low housing inventory and a large renter population, both of which can work in investors’ favor. Best of all, Orlando’s real estate market is moderately priced, with the average property costing just over $370,000.

Miami stands out as a global city with strong rental income and consistent property appreciation. The average home price is over $585,000, and single-family home values have nearly tripled since 2013, highlighting long-term growth potential. Renters make up a large portion of the population, with average monthly rent topping $2,100, which is 37% higher than the national average. Miami’s three major universities also bring in around 80,000 students, adding steady demand for rental housing.

Often overshadowed by nearby Tampa, St. Petersburg has carved out a name for itself and has been named a real estate market to watch. “St. Pete” has an artsy vibe, a revitalized downtown, and 94 distinct neighborhoods. It also has a growing tech scene with an expected 13.4% more computer and math jobs added to the city by 2026. Lower property prices, waterfront views, and a strong sense of community make it an attractive alternative to larger cities.

With more than 400 miles of canals, Cape Coral stands out as a uniquely laid-out and fast-growing city in Southwest Florida. Its population has surged by 26% over the past decade, driving strong demand for rental housing, especially single-family homes. Despite this rapid growth, Cape Coral remains relatively affordable, with average home values around $363,443. That’s a bargain compared to neighboring markets like Naples and Fort Myers.

Located in the Florida Panhandle, Pensacola offers a blend of military and tourism-driven demand. Home to Naval Air Station Pensacola, the city sees a steady need for rentals among military families and contractors. Pensacola Beach is also a popular spot for vacationers, inviting investors to pursue long- or short-term rentals. Finally, low property taxes and affordable prices (the average property is $254,999, the lowest on our list) make Pensacola even more appealing for investors.

Florida presents unique challenges and opportunities for real estate investors. Here are a few factors to keep in mind:

Getting a DSCR loan in Florida is simpler than most investors expect. Here’s how it works:

1. Find a profitable investment

The key to qualifying for a DSCR loan is selecting a property that generates strong rental income. Start by working with your real estate agent to identify properties with high rental potential. Before making an offer, carefully evaluate how each property aligns with your overall investment strategy and financial goals.

2. Gather essential documents

Gather the necessary documentation. This includes a valid passport (from your home country), proof of income such as bank statements, and property details that will show that it will be a profitable investment. Lenders may also request proof of assets or a credit report from your home country if applicable.

3. Select a lender experienced with foreign nationals

When looking for a lender, it's essential to choose one who understands the specific challenges foreign nationals face. You’ll want a lender experienced in verifying foreign income and working with applicants who don’t have a U.S. credit history. At Waltz, we specialize in DSCR loans for foreign investors–it’s what we do everyday.

4. Set up an LLC and U.S. bank account2

To get a DSCR loan, you need to set up a U.S.-based LLC and a U.S. bank account. While this process can be time-consuming, Waltz makes it easier with our Investor Toolkit, allowing you to quickly establish both your LLC with an EIN and a U.S. bank account, eliminating potential delays and streamlining your path to financing.

5. Submit your loan application

Before submitting your application, it’s a good idea to speak with an account executive who can address any questions and help ensure you're on track. They’ll help you understand the necessary documentation, including property details, your financial information, and proof of income, to make the process more efficient. Once everything is in place, submitting your application will be quick and seamless.

6. Perform due diligence

As part of the due diligence process, there will be a property inspection and an appraisal. The lender may also request additional documents to verify the property's condition and value. Lastly, take time to carefully review the term sheet to ensure the loan terms align with your investment goals.

7. Complete the purchase process

Once your loan is approved and due diligence is complete, you’re ready to close the deal. Sign the necessary paperwork to finalize the sale—if you're outside the U.S., Waltz can arrange a virtual signing. After that, transfer the funds, and you'll officially own your rental property in Florida!

Refinancing your investment property in Florida involves replacing your existing mortgage with a new one. For foreign nationals, the refinancing process typically includes:

Waltz Will Help You Invest in Florida Real Estate

To get the best possible rate, focus on factors that improve your risk profile. A higher DSCR (typically 1.25+), a lower loan-to-value ratio (LTV), and strong rental income projections all help.

Yes. DSCR loans are strictly for real estate investment purposes—not primary residences or vacation homes.

A DSCR of 1.0 is the minimum to qualify. A DSCR of 1.25 or higher is considered strong and can help you get better terms.

DSCR loans are based on property cash flow. Conventional loans require personal income docs, W-2s, and credit checks.

Timelines vary by lender, property type, and the speed at which documents are provided. While DSCR loans can close in around 30 days, international buyers may take longer with traditional lenders due to additional verification steps. Waltz streamlines this process—many investors we work with can close in approximately 30 days once documents and property details are submitted.

Waltz specializes in residential 1–4 unit properties. Commercial DSCR loans are available from some lenders but may follow different guidelines.

Typically 25–30%, though some investors may qualify for lower with a strong DSCR and rental income.

Yes. Waltz specializes in helping non-U.S. investors qualify for DSCR loans: no U.S. credit or income needed.

No. DSCR loans are for income-producing rent-ready rental properties, not fix-and-flip projects.

Yes., they rely on property income, not personal income, DSCR loans make it easier to scale.

No. These loans are for non-owner-occupied investment properties only.

Not personal income, just proof of rental income or market rent projections for the property.